The previously applicable country-specific delivery thresholds for the obligation to report VAT in the EU countries will be abolished as of July 1, 2021, and replaced by an EU-wide minimum threshold of €10,000. Companies that have so far spared the effort to distribute their goods across Europe can also use this new regulation as an opportunity.

Up to now, sales tax from the sale of goods to private individuals in the European Union had to be paid in the respective EU member state in which the sold goods arrived or were consumed. To do this, companies had to register in each EU country. There were delivery thresholds per country, usually at €10,000.

Register once and sell goods throughout the EU

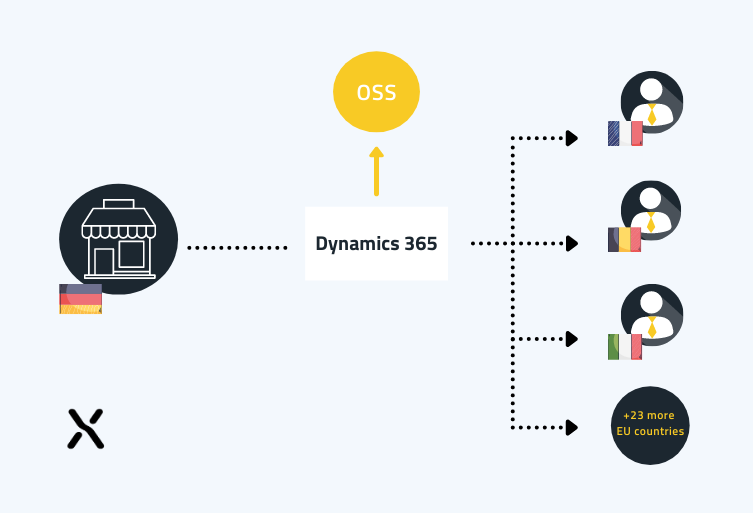

From early summer 2021, traders will be allowed to report and pay VAT centrally, via the country in which they have their registered office, e.g. Germany, via the so-called one-stop store in the EU member states. For this purpose, the tax authorities are to provide a technology through which they can report the sales centrally and also pay the VAT centrally – the so-called One-Stop-Shop, which will serve as a single point of contact. The advantage of this is that it offers companies and traders the opportunity to be active throughout Europe. To do this, it is only necessary to register once.

xalution supports you in setting up the One-Stop-Shop (OSS) in your Dynamics 365. Contact us today and be optimally prepared for July 01. 2021